January 2014 – An Economic and Market Update

EXECUTIVE SUMMARY

- 2013 ended with one of the strongest performing years on record for the stock market [i]. The performance and new record highs have initiated discussions among many as to whether or not we are in a new financial bubble. [ii]

- The labor market is showing a sign of improvement as recent private market hiring has been stronger than anticipated with 238,000 jobs being added in December [iii].

- The long term impact of a rising interest rate environment may be starting to show as Core Bond holdings and Real Estate under-performed relative to other asset classes.

- Continued growth of emerging economies is showing itself in global consumption patterns, [iv] how the emerging economies continue to urbanize will be a strong indicator of where growth in the future will come from.

| MAJOR STOCK INDICES | YTD 2013 |

| S&P 500 | +32.4% |

| Russell 2000 | +33.23% |

| S&P GSCI Index | -2.13% |

| Barclays Bond Agg | -4.07% |

| MSCI EAFA | +23.3% |

| Wilshire US REIT | -2.46% |

January 1, 2013 to December 31, 2013 | |

YEAR END

The U.S. economy finished off 2013 mixed in regards to GDP figures. With upward revisions to 3rd quarter Gross Domestic Product (GDP) from 2.8% to 4.1% it was a strong start to the end to the year. Early estimates of 2% growth for the 4th Quarter, however, suggest a slowed expansion as we closed 2013. due to both the government shutdown and inclement weather. When the first official measurement of 4th quarter GDP is made available on January 30th we will see how much the government shutdown and inclement weather really impacted the country. [vi,vii]

The Federal Reserve has also been encouraged by the strengthening economy and finally committed to the tapering process on December 18, 2013. The unwinding will occur in a deliberate fashion, however, as the $10BILLION/month reduction in bond purchases means they will still continue to purchase $75 BILLION/month in various debt instruments as they seek to keep interest rates stable. The stock markets responded to the Fed announcement by setting new record highs. While tapering appears to be making the markets happy, the record highs have other questioning the strength of the economy.

ARE WE IN A BUBBLE

The last trading day of 2013 saw the 52nd record high in the stock market set for the year [viii]. It was a banner performance in terms of total return, as the S&P 500 was up 32.4% on the year. The fresh market peak coming soon after the financial crisis has many people nervous. In fact Robert Shiller, one of the most celebrated economists in recent decades and Nobel Prize winner in Economics, recently stated that, “the Federal Reserve’s economic stimulus and growing market speculation were creating a “bubbly” property boom.” [ix]

Spotting a bubble though, is not as easy as looking at stock market returns and real estate values; nor does it resemble a science. Vikram Mansharamani, lecturer at Yale University and author of Boombustology: Spotting Financial Bubbles Before They Burst (Wiley, 2011), argues that spotting bubbles is a function of being an effective generalist able to pull data from all over the spectrum of knowledge in order to form conclusions.

It is nearly impossible to determine if we are in another financial bubble. However, by recognizing that the world is a, “highly interconnected and global economy”, which, “means that seemingly unrelated developments can affect each other” [x], diversification has the opportunity to work for us.

THE LABOR MARKET

Since March of 2009 the stock market has recovered 173%, the Unemployment rate has fallen from 10% in October 2009 to 6.7% in December 2013, and the Labor Participation Rate (the percentage of working age individuals employed) has dropped from 66% to 62.8% [xi].

As illustrated by the numbers above during the last 4 years the employed and invested have done well while the unemployed and un-invested have not. Unemployment benefits have been extended multiple times during the recovery in an attempt to ease the pain. However, the most recent extension attempt fell flat in Congress as elected officials wrestled over extending the benefits by 12 months, 3 months, or some number in between [xii].

The 4th Quarter of 2013 hiring figure suggests the labor market is gaining traction. Hopefully it occurs quick enough to help those impacted by expiring unemployment benefits, which should only serve to provide more fully employed people who can help continue our economic recovery.

FIXED INCOME

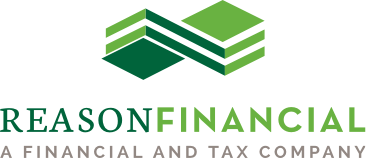

The fixed income market appears to be at the beginning of a cycle not seen for many years, a long-term rising interest rate environment. While the path is not a perfect up or a perfect down, interest rates over the last 60 years have posted two fairly clear cycles. From 1958 to 1981 interest rates rose, and from 1982 to 2012 they fell. [xiii]

Source: Federal Reserve, BLS, J.P. Morgan Asset Management.

Real 10-year Treasury yields are calculated as the daily Treasury Yield less year-over-year core inflation for that month except for December 2013, where real yields are calculated by subtracting out November 2013 year-over-year core inflation. All returns above reflect annualized total returns, which include reinvestment of dividends. Corporate bond returns are based on a composite index of investment grade bond performance. Guide to the Markets – US. Data are as of 12/31/13

With the beginning of the end of Quantitative Easing, interest rates are likely to continue rising. As past history shows, we do not expect the path up to be even and predictable. However, Janet Yellen, the newly confirmed Federal Reserve Chair, has stated that she “would follow in her predecessor’s footsteps on quantitative easing and believes in loose monetary policy.” [xiv] Slowly easing off the easy money gas pedal will, hopefully, allow response time should any negative financial repercussions occur.

Asset classes tied to interest rates performed poorly in 2013 with core fixed income down 4.07% and real estate down 2.46%. If we are truly in a long term rising interest rate cycle managing these risks will be key factors in our ongoing investment management strategy. We remain committed to short duration bond funds to protect against potentially volatile interest rates.

International Equities

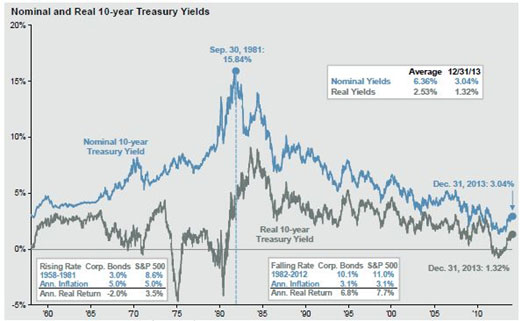

Developed international markets performed admirably in 2013, though not to the same degree as the United States, posting a 23.3% gain as measured by the MSCI EAFE index. Emerging markets cannot make the same claim, having posted a -2.3% return. The U.S. may have moved past the stock market peak of 2007, but international markets have not.

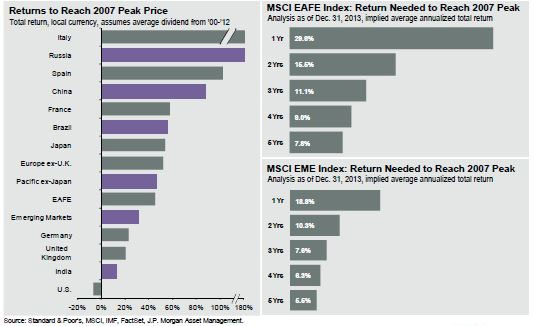

A key factor in understanding how much growth potential exists internationally is in the impact of urbanization on raising per-capita income. While the past experience of countries such as the United States and Japan cannot be perfectly overlaid on China and India, it is clear that a driver of future growth will come in the form of hundreds of millions of people moving from the farm to the city.

Global consumption by Emerging markets has already surpassed that of the United States. China and India may not reach the same level of GDP per Capita as other developed economies, only time will tell, but even coming close will signify dramatic consumption increases over current levels. This is a significant investment growth opportunity in the decades to come.

OUR THOUGHTS

The rising interest rate environment and continued urbanization of the developing world create an interesting future for investment management which we will continue to monitor. As we do so we will do our best to protect value and follow through on our mission to provide sound advice so that our clients can make good decisions.

We remain committed to both the protection of your assets and the growth of your investment portfolio, and want to thank you for your continued trust and support.

We welcome your input and ask that you contact us with any questions or concerns.

DISCLOSURE

All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.

An index is statistical measure of change in an economy or a securities market. In the case of financial markets, an index is an imaginary portfolio of securities representing a particular market or a portion of it. Each index has its own calculation methodology and is usually expressed in terms of a change from a base value. Thus, the percentage change is more important than the actual numeric value. An investment cannot be made directly into an index.

Investing in fixed income securities involves credit and interest rate risk. When interest rates rise, bond prices generally fall. Investing in commodities may involve greater volatility and is not suitable for all investors. Investing in a non-diversified fund that concentrates holdings into fewer securities or industries involves greater risk than investing in a more diversified fund. The equity securities of small companies may not be traded as often as equity securities of large companies so they may be difficult or impossible to sell. Diversification nor asset allocation assure a profit or protect against a loss in declining markets.

Past performance is not an indicator of future results.

Securities offered through 1st Global Capital Corp., Member FINRA and SIPC. Bruce Rawdin-Baron, Steven W. Pollock, Sean Storck and Nicole Albrecht are Registered Representatives of 1st Global Capital Corp. Investment advisory services, including RBFI portfolios offered through Rawdin-Baron Financial, Inc. IMS platform accounts offered through 1st Global Advisors, Inc. Rawdin-Baron Financial, Inc. and 1st Global Capital Corp. are unaffiliated entities. Rawdin-Baron Financial, Inc. is a Registered Investment Adviser. Insurance services offered through 1st Global Insurance Services. Registration does not imply a certain level of skill or training. We currently have individuals licensed to offer securities in the states of Arizona, California, Illinois, Indiana, Kansas, Massachusetts, Michigan, New York, Oregon and Washington. This is not an offer to sell securities in any other state or jurisdiction. CA Department of Insurance License: Bruce Rawdin-Baron #0736631, Steven W. Pollock #OE98073, Sean Storck #0F25995 and Nicole Albrecht #0F99962.

Copyright © 2013 Rawdin-Baron Financial Inc., all rights reserved.

Rawdin-Baron Financial, Inc., 4747 Morena Blvd, Ste 102, San Diego, CA 92117

Endnotes:

i. CNN.com, Stocks: Stellar Year Ends on a High Note, 12/31/13

ii. CNBC.com, Nobel Prize winner warns of US stock market bubble, 12/2/13

iii. CNBC.com, Private Job Creation is ‘Off and Running’: ADP, 01/08/14

iv. Factset, United Nations, J.P. Morgan Global Economics Research, J.P. Morgan Asset Management

v. Bureau of Economic Analysis, National Income and Product Accounts, 12/20/13

vi. Bureau of Labor Statistics (BLS),

vii. Bloomberg.com, Fourth-Quarter U.S. GDP Forecasts Lowered on Shutdown, 11/01/13

viii. CNN.com, http://money.cnn.com/2013/12/31/investing/stocks-markets/, 12/31/13

ix. CNBC.com, Nobel Prize winner warns of US stock market bubble, 12/2/

x. Vikram Mansharamani, Embrace the Power of Foxy Thinking, Harvard Business Review 06/06/12

xi. Bureau of Labor Statistics (BLS), FactSet, J.P. Morgan Asset Management

xii. Reuters.com, U.S. Unemployment Benefits Extension Stalls in Senate, 01/09/14

xiii. Federal Reserve, Bureau of Labor Statistics (BLS), J.P. Morgan Asset Management

xiv. Forbes.com, She’s Confirmed: Janet Yellen Is First Woman Federal Reserve Chair, 01/06/14